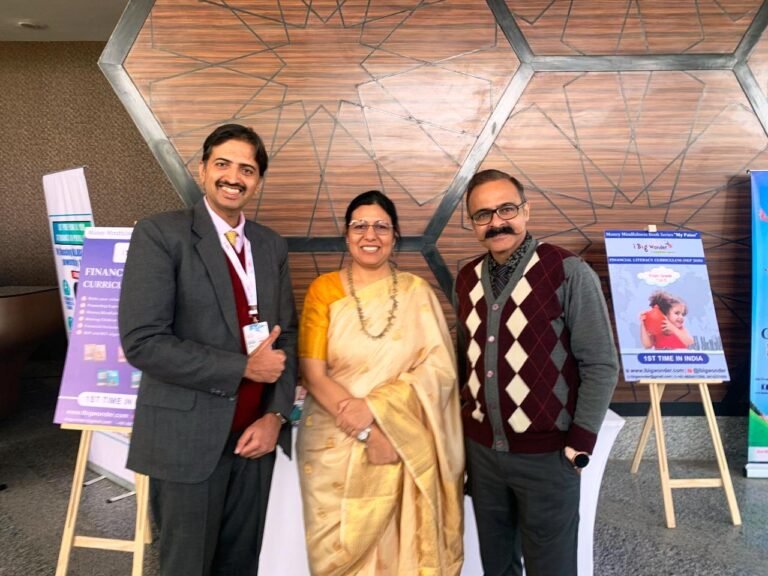

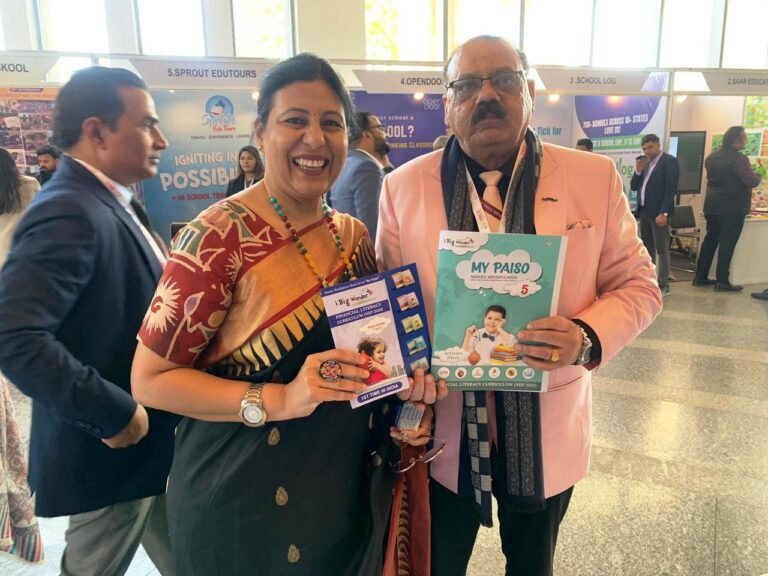

FINANCIAL LITERACY – Money Mindfulness Curriculum

After all the Literacy, Knowledge & Awareness we are still struggling to teach our children the value of money. So many parents I meet complain they are sick and tired of kids asking for things; “why don’t they value what they have”? “Why are they always asking for more?”

Managing money is a life skill and needs to be taught both at home and at school. We give our kids swimming lessons in order to keep them safe in water; we don’t throw them in the deep end and expect them to swim.

And the same principle needs to be applied to ensuring they are safe with money and know how to budget and how to be justified consumers and savvy savers, if they are going to cope in adult life.

The generation is surely going to thank the parents and teachers to have helped them grow one of the most essential Life Skill, for not only surviving but thriving.

This Curriculum MY PAISO… is designed for ages 8-13 years , Level 1 to Level 5. Carefully crafted Lessons & Practice Worksheets for fun filled engagement.

It’s common knowledge that children absorb a lot from their surroundings, be it responding in social situations, reacting to strong emotions, or mimicking others’ behavioural patterns; all of this is inevitable. It’s no surprise that parents and teachers consciously encourage good values and qualities among children.

Parents always want to imbibe good qualities among their children, some of which may include greetings, appropriate social responses, building patience, respectful behaviour towards people of all ages, and more. While teaching children these soft skills definitely go a long way, there are some real-life skills that they need exposure to from a young age.

One of the core life skills that could be resourceful for children to thrive in a competitive environment is financial literacy. The basics of the subject largely contribute to the financial capabilities of a consumer. Financially literate consumers better understand how to manage their resources and make well-informed financial decisions. In the long run, it will contribute to increasing economic security among the youth.